Related Jobs

View all jobsData Scientist

Data Scientist

Data Scientist - New

Data Scientist - Contract - 12 months

Data Scientist (Globally Renowned Retail Group)

Subscribe to Future Tech Insights for the latest jobs & insights, direct to your inbox.

Industry Insights

Discover insightful articles, industry insights, expert tips, and curated resources.

Maths for AI Jobs: The Only Topics You Actually Need (& How to Learn Them)

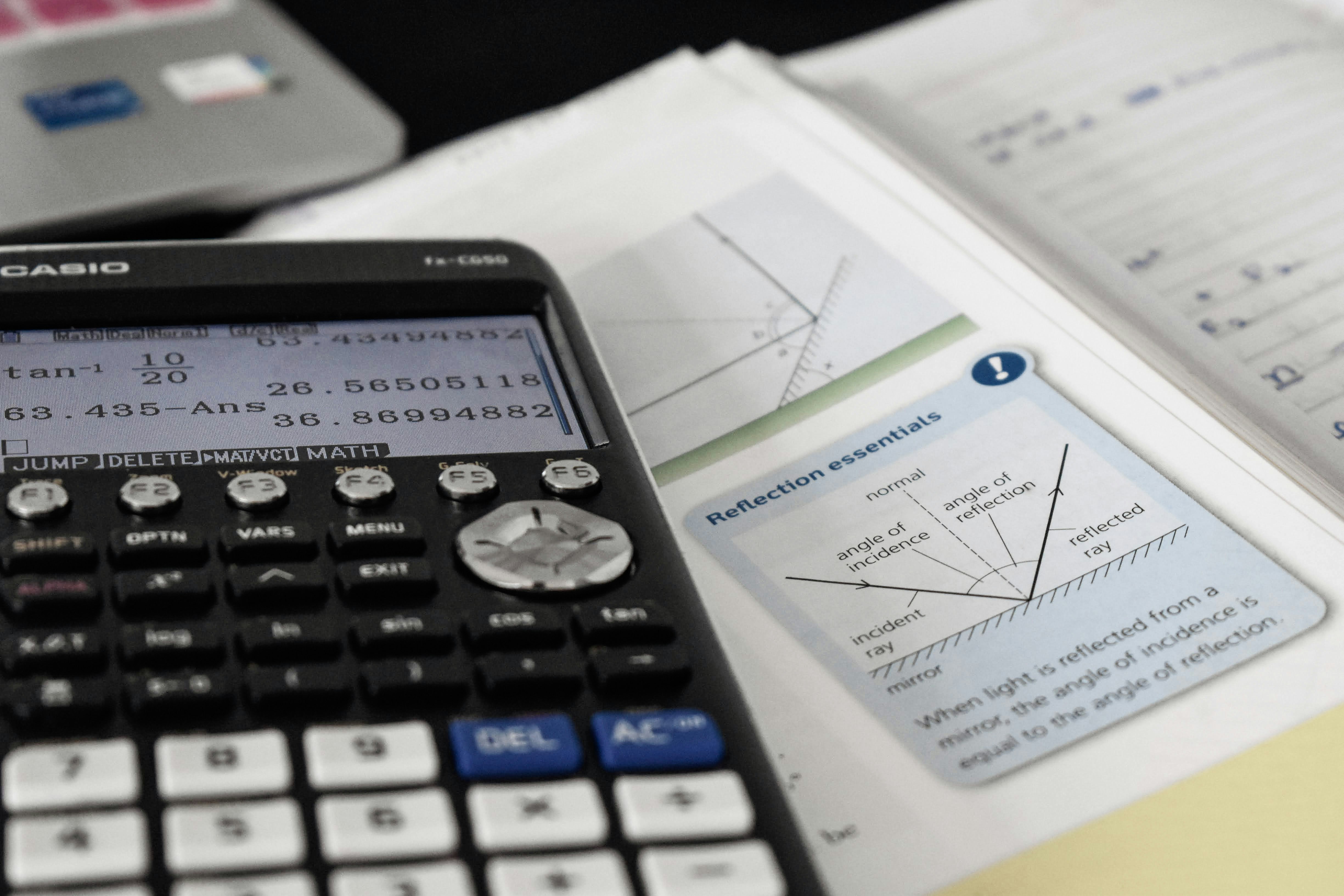

If you are a software engineer, data scientist or analyst looking to move into AI or you are a UK undergraduate or postgraduate in computer science, maths, engineering or a related subject applying for AI roles, the maths can feel like the biggest barrier. Job descriptions say “strong maths” or “solid fundamentals” but rarely spell out what that means day to day. The good news is you do not need a full maths degree worth of theory to start applying. For most UK roles like Machine Learning Engineer, AI Engineer, Data Scientist, Applied Scientist, NLP Engineer or Computer Vision Engineer, the maths you actually use again & again is concentrated in a handful of topics: Linear algebra essentials Probability & statistics for uncertainty & evaluation Calculus essentials for gradients & backprop Optimisation basics for training & tuning A small amount of discrete maths for practical reasoning This guide turns vague requirements into a clear checklist, a 6-week learning plan & portfolio projects that prove you can translate maths into working code.

Neurodiversity in AI Careers: Turning Different Thinking into a Superpower

The AI industry moves quickly, breaks rules & rewards people who see the world differently. That makes it a natural home for many neurodivergent people – including those with ADHD, autism & dyslexia. If you’re neurodivergent & considering a career in artificial intelligence, you might have been told your brain is “too much”, “too scattered” or “too different” for a technical field. In reality, many of the strengths that come with ADHD, autism & dyslexia map beautifully onto AI work – from spotting patterns in data to creative problem-solving & deep focus. This guide is written for AI job seekers in the UK. We’ll explore: What neurodiversity means in an AI context How ADHD, autism & dyslexia strengths match specific AI roles Practical workplace adjustments you can ask for under UK law How to talk about your neurodivergence during applications & interviews By the end, you’ll have a clearer picture of where you might thrive in AI – & how to set yourself up for success.

AI Hiring Trends 2026: What to Watch Out For (For Job Seekers & Recruiters)

As we head into 2026, the AI hiring market in the UK is going through one of its biggest shake-ups yet. Economic conditions are still tight, some employers are cutting headcount, & AI itself is automating whole chunks of work. At the same time, demand for strong AI talent is still rising, salaries for in-demand skills remain high, & new roles are emerging around AI safety, governance & automation. Whether you are an AI job seeker planning your next move or a recruiter trying to build teams in a volatile market, understanding the key AI hiring trends for 2026 will help you stay ahead. This guide breaks down the most important trends to watch, what they mean in practice, & how to adapt – with practical actions for both candidates & hiring teams.